If you want to know the costs in purchasing a home, then here is the right blog post you need.

I share all the numbers for my first home. Hope you find it useful.

If you want to know the costs in purchasing a home, then here is the right blog post you need.

I share all the numbers for my first home. Hope you find it useful.

Do Not Be Fearful & Be Careful of Too Many Voices Before I continue from last week’s blog post, I would like to share a bible verse. Proverbs 11:4 KJV says, “Where there is no counsel, the people fall; but in the multitude of counsellors, there is safety”. We will get back to this laterContinue reading “Warlingham Close – Part 2”

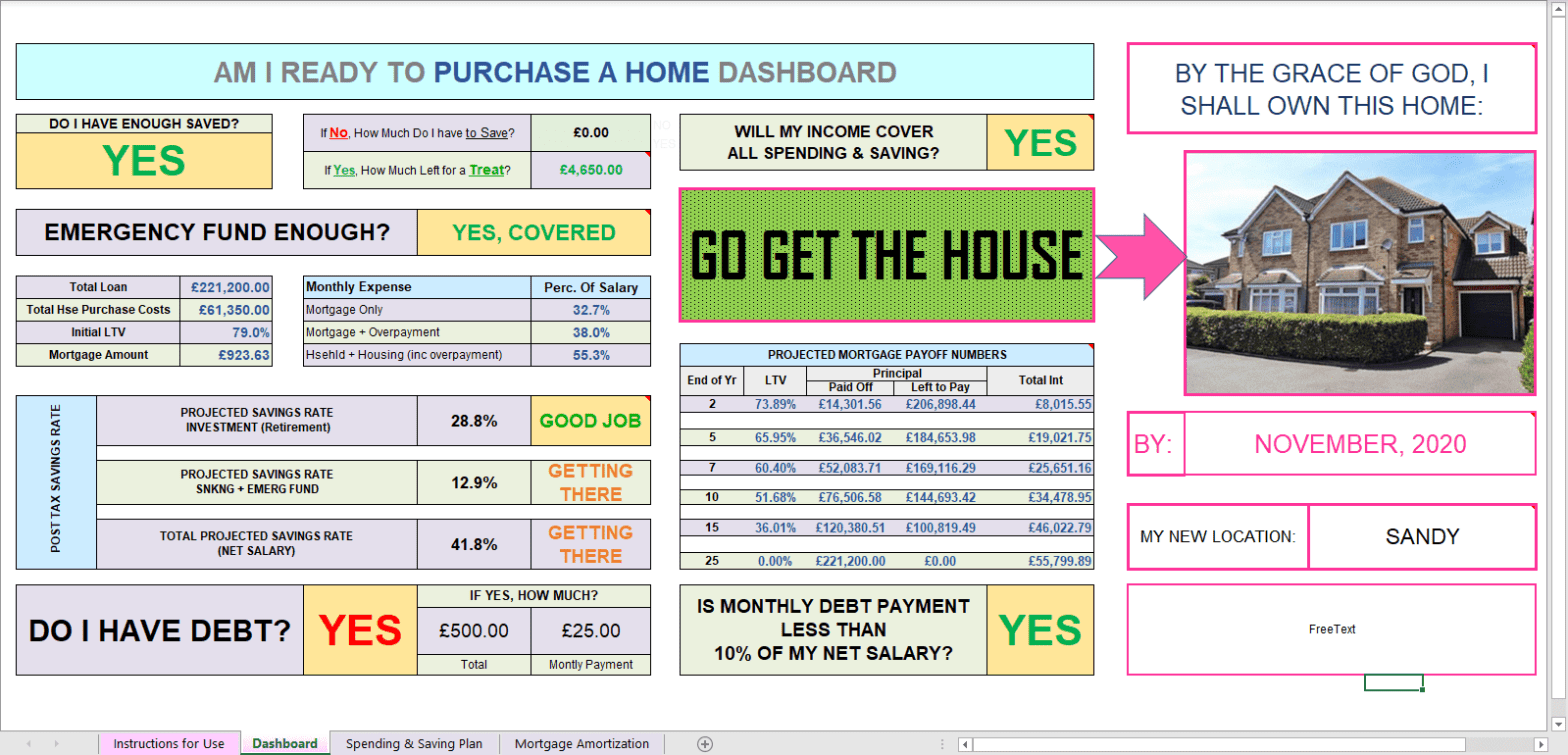

An example of a house purchase process and lessons learned that you may find useful and helpful

We all look forward to buying our first home. The costs associated with these can be quite high.

In this blog, we discuss some ways to save for a deposit and the house purchase costs.

We have also provided a link to a useful tool.

Enjoy!

View post to subscribe to the site’s newsletter.

A Budget or Spending Plan should always make space for adjustments. Life happens and this needs to be accounted for. Depending on what stage of the financial lifecycle you are in, life can throw a spanner into the works at any time; an unexpected purchase – new electronic product because the old gave up ORContinue reading “Adjustments – Life”

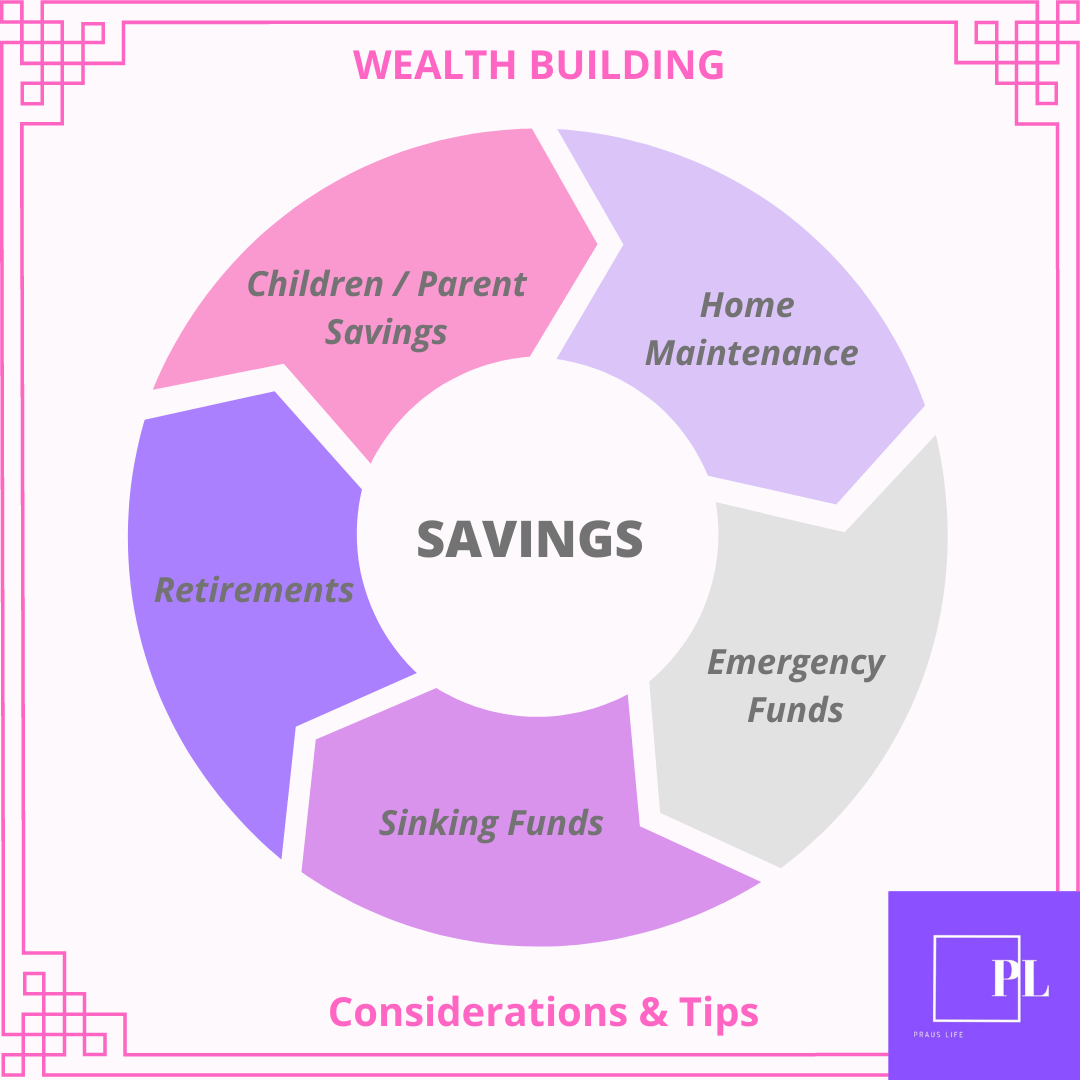

Let us talk about Savings and Investments; split into ‘savings for now’, rainy day funds and retirement. Savings = Keeping for Now and Later. Emergency Funds Retirement & Pensions Sinking Funds Home Maintenance Funds Children/Parent Assistance Fund The first thing to do is to decide your goals and life aims. Save for Emergencies & YourContinue reading “Keeps – Savings”

Going Outs is what I call Expenses. Anything you spend money on is an EXPENSE. Your Savings Are Savings. – Praus Life Finance What is Included in the Expense Category? Life basics – housing, food, clothing, health, transportation, basic communications – are the essence of any Spending Plan and form the basics of the ExpensesContinue reading “Going Outs – Expenses”

This will cover all your income, earnings, rebates i.e. incoming money. Things to consider include: All Earnings Frequency of Payments Expected AND confirmed rebates etc The first part of a Spending Plan is to calculate how much money you have coming in each month or 4-week period. It is much easier for those on fixedContinue reading “Clue On – Income”

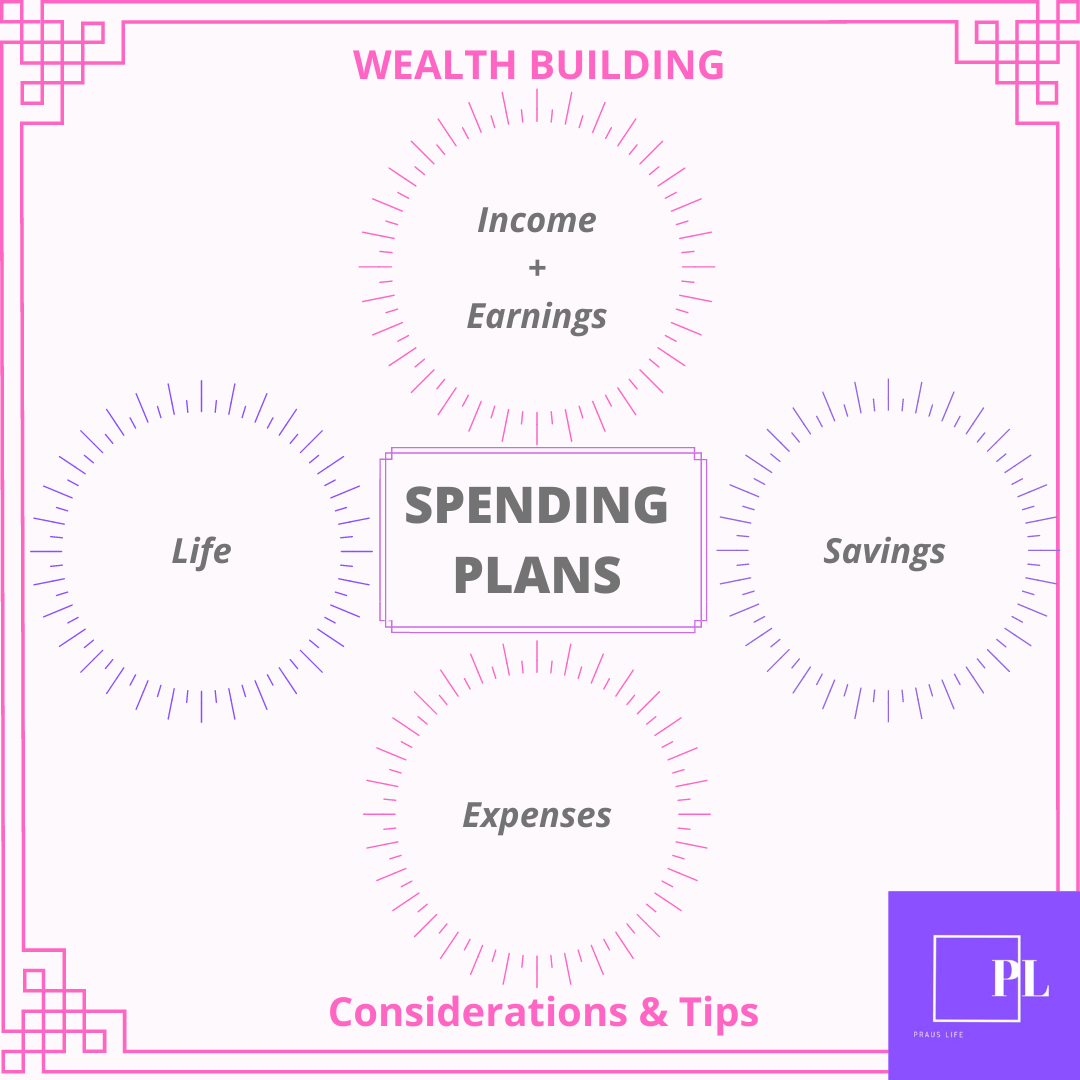

Some call it Budgets and others call it Spending Plans. I prefer to call these Spending Plans. Have a clue what is coming in, plan for what will go out, know what needs keeping and make room for life. – Praus Life Finance A Spending Plan (or Budget as some call it) is key toContinue reading “Spending Plans”

I currently have a LISA (Lifetime ISA) and plan to use it to buy home or for retirement. This blog post is to give a brief on the LISA, its features and how you can utilise it towards your first home purchase or as a retirement account. Assuming Maggie is a 37yo lady who doesn’tContinue reading “What Would I Do With A LISA?”