Dear Daughter,

I recently received some questions on the term Dollar Cost Averaging (DCA) -what it really means & why DCA when investing. Taken the opportunity explaining this as much as I can in this post. I hope you find it useful.

For the purposes of this post, please change the currency to your local currency to make it easier to understand. I am writing from the UK and since BreXit is now in full swing and thankfully, we will not be using the Euro ever (insert BIG SMILE), we will refer to this as Pound Cost Averaging.

From a layman’s point of view, DCA is basically employing regular investing to obtain the benefit of a rise and fall in the market. You note, I say the benefit of a fall. Yes I did and will get into it soon.

I explain in more detail below:

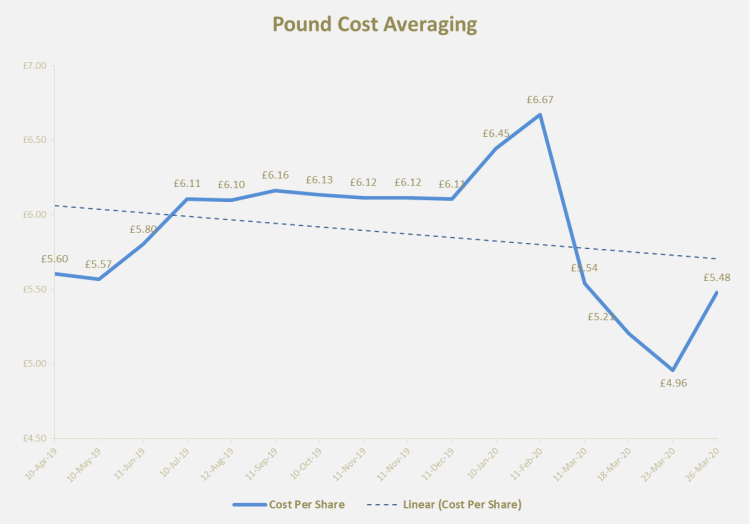

Figures 1 below shows the price of a unit of the same fund purchased over the period, April 2019 to Mar 2020.

I currently invest a regular amount each month by Direct Debit. My S&S ISA provider usually purchase funds on the 10th of each month. According to them, doing this for all customers allows them to offer us cheaper fees etc. I digress.

If you would rather a table, I have presented the same information in Table 1 – scroll down to view.

So…assuming I have £100 being added to my Stocks and Shares ISA each month, it implies that the number of shares I will buy (and hold) that month is:

Number of Shares = Monthly regular Investing Amount / The Cost or Price of Shares at time T

T – Time at which my provider submitted my order for the shares to be purchased.

On 11-Feb-2020 at the peak of the market, it costs me £6.36 to purchase 1 unit of the fund. £100 would give me (£100/6.36) = 15.7 units.

On 23-Mar-2020, which was the lowest, it cost me £4.96 to purchase a unit of the fund. £100 would give me (£100/£4.96) = 20.2 units.

Note that within a month, prices had changed dramatically. The point is, no matter how much prices fell to, in March, 2020 I still owned the 15.7 units I had purchased in Feb 2020. Assuming, the price for a fund unit remained £4.96 in March, selling a portion or all of my fund would have resulted in a loss.

I do not sell. My strategy is buy and hold.

Undertaking the same calculations for the entire period, investing £100 on a regular basis, gives an example in the table below:

| Date | Cost Per Share | No of Shares |

|---|---|---|

| 10-Apr-19 | £5.60 | 17.85 |

| 10-May-19 | £5.57 | 17.96 |

| 11-Jun-19 | £5.80 | 17.24 |

| 10-Jul-19 | £6.11 | 16.37 |

| 12-Aug-19 | £6.10 | 16.40 |

| 11-Sep-19 | £6.16 | 16.22 |

| 10-Oct-19 | £6.13 | 16.31 |

| 11-Nov-19 | £6.12 | 16.35 |

| 11-Nov-19 | £6.12 | 16.35 |

| 11-Dec-19 | £6.11 | 16.38 |

| 10-Jan-20 | £6.45 | 15.52 |

| 11-Feb-20 | £6.67 | 14.99 |

| 11-Mar-20 | £5.54 | 18.04 |

| 18-Mar-20 | £5.21 | 19.21 |

| 23-Mar-20 | £4.96 | 20.17 |

| 26-Mar-20 | £5.48 | 18.25 |

Dear daughter, not knowing if you love graphs or tables or words, I have also produced a quick graph for you. ENJOY! It shows, prices and number of shares is inversely related i.e. when prices are low, you are more likely to get a higher number of shares when investing the same amount.

From the graph it looks like my shares have on a monthly basis, cost more than the average of £5.85. However, there is something you need to know.

DCA has proven and ensured that over the investment period Apr 2019 to Mar 2020, each share has (in theory) not costed more than £5.85 per share. I.e. although I had spent more per share in some months, the benefit of DCA ensured that in other months, I had bought more shares and had kind of ‘equalled out’ if I can use that word.

A keen eyed girl like you, would note that in Nov-19 and Mar-2020 I ended up buying more shares than my usual regular monthly investment. Although I do NOT time the market, I realised that in March 2020, prices had returned to April 2019 values and with some cash reserves I had, decided to buy some more stocks and shares.

Advice – NEVER dip into your emergency savings to invest. Thankfully I did not. I had planned to open a SIPP with the cash and since I hadn’t come round to doing so, decided my money was better off in the market (CLAP for Compound Interest benefits) than in a bank earning a miserly 1%AER.

Never dip into your emergency savings to invest.

— An Anonymous Wise Human

I hope this makes sense. And if it doesn’t, I may be alive to explain it OR you will find someone to.

Your takeaways from this post:

- Invest often and regularly.

- Ignore what the market is doing

- Monthly or fortnightly investing is likely to protect your investments

- Do not time the market. Rarely does any one create wealth this way.

Thanks for the explanation. It is very well detailed and one main point to take is to invest not looking at the market. Just start inventing !!

LikeLike